The Theory…

I had the privilege of addressing the delegates from several countries at the OECD’s Global Forum on Competition in 2006 (see the presentation). As one of the lead discussants, I summarized the relationship between competition and concessions in just 15 minutes. Therefore, I decided to sum up the whole issue in one chart, and later on, in my seminars, I had the chance to elaborate on the case using the scenario below:

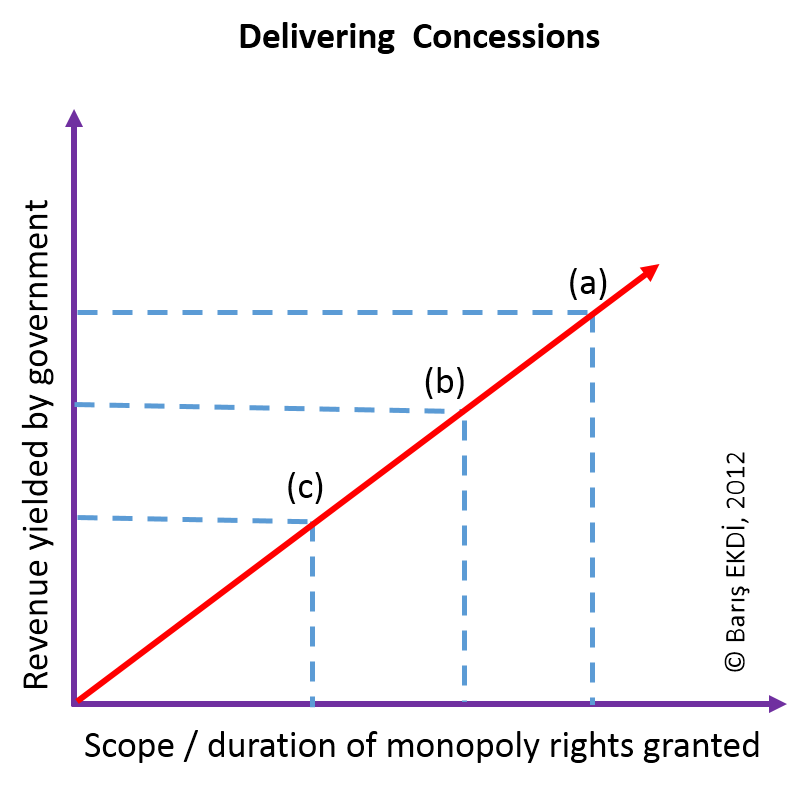

Let’s assume that the government or a public authority decides to privatize an asset or deliver a concession through a bidding process, and you are an investor with almost unlimited funds. There are three options the authorities are considering:

a) Delivering the asset or concession with monopoly rights – i.e., no one would interfere with the decisions or operations of the winner after the rights are granted so that it may enjoy monopolistic practices.

b) Delivering the asset or concession while keeping the monopoly by blocking further access to the market, but also introducing some sort of regulation or supervision (especially on pricing) to limit the powers of the grant holder.

c) Delivering the asset or concession while opening up the market for newcomers either by dividing the assets into substitutable chunks or introducing a kind of liberalization schedule.

Here are the crucial questions:

– If you were – the investor, which option would you pay for most?

– If you were the consumer or customer enjoying the services subject to the concession, which option would you prefer?

– If you were the government / public authority, what would you do?

Almost in all seminars, the answers were quite straightforward and predictable for investors –who chose option (a) and customers who opted for (c) since they were maximizing their profits and utilities, respectively.

However, when it comes to the government, it is usually seen that public authorities also tend to choose option (a) since it brings most of the revenue directly in the short run (i.e., the worth of the bid is higher), and indirectly in the long run (through taxation of monopoly profits). Especially where the success of bids is measured according to the revenue yielded, consumer welfare or long-run effects become secondary issues. As a result, if no countervailing powers such as powerful non-governmental organizations or competition authorities could raise public attention and intervene with the process, delivering concessions or privatizations may easily end up granting monopoly rights and less customer welfare.

All the arguments above can be illustrated as follows:

The Practice …

After reading the introduction above, I believe that followers of this blog would easily grab the issue: In two posts (“Sea Fight in Marmara” and “Sea Fight in Marmara II: TCA out of the game”) of this blog [Turkish Competition Bulletin] it is stated that;

– just after the privatization of IDO, which is the operator of many ferries in the Marmara Sea, the prices skyrocketed,

– as a response, a new company decided to enter the market by buying two ferries,

– the incumbent stated that they had paid USD 862 million for the lines since the public authority assured them no one would enter the market, so unless the newcomer would pay the same amount, the new entry had to be declared illegal,

– after numerous complaints about rising prices, the Turkish Competition Authority investigated the issue and decided that there was no evidence of abuse of the dominant position yet and emphasized the opinion delivered –in which the TCA proposes to divide up the lines to introduce competition or establish some price regulation – before privatization process.

In short, the municipality has chosen to get most of the revenue by granting monopoly rights as in option (a), while the TCA proposed options (c) and (b). Then, the incumbent raised the prices to extract the USD 862 million as soon as possible, and customers started to suffer. So, the practice followed the theory, albeit with failure.

Yet again, there are two theories to be tested in due course:

1) Regarding the abuse of dominance by excessive pricing, the TCA decided that the IDO was cross-subsidizing the loss-making lines, so there was no breach of Article 6 (equivalent to Article 102 EC). It is unclear whether there was no abuse of dominance or the practice enjoyed non-existent Article 106 EC provisions.

2) The incumbent claims that the newcomer should also pay USD 862 million for the access, probably to deter the entrant. Since there would be no room left for extracting monopoly profits, the worth of the lines would be much less, and the entrant would be reluctant to pay that much. So, there is a new dilemma waiting for policymakers: On the one hand, if they claim USD 862 million for access, the entrant would probably give up. On the other hand, if they let the entrant access the market for free, the incumbent would be forced to operate in a disadvantaged position with high sunk costs.

As a result, if you wonder about the answers, the theory can enlighten the paths, but only time will tell the road chosen…

* This article was first published in The Turkish Competition Bulletin on December 31, 2012.

The views expressed in this article are solely belong to the author and do not necessarily reflect the views of or binding for the third parties.