Brian Arthur generalized his model to study economic processes like standardization, network effects, and so-called ‘increasing returns.’ The model assumes that the choices made by previous adopters from among competing technologies will matter for individual consumers. This model can explain why QWERTY became the standard keyboard in some geographies, although it may not be the most efficient or preference for some operating systems over others.

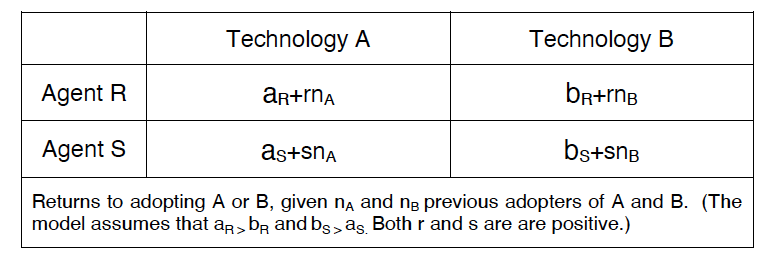

Therefore, in his model, there are two agents, namely R and S, with a ‘natural’ inclination to one of the technologies, A or B, respectively (as aR, bR, aS, bS in the model). However, apart from this inclination, the agent also takes the returns (and network effects) of those competing technologies while making his/her choice. Therefore, the number of previous adaptors chosen for one of the technologies does matter. So, the model is as follows:

According to the model, R and S type agents enter the market randomly and choose according to the returns of competing technologies.

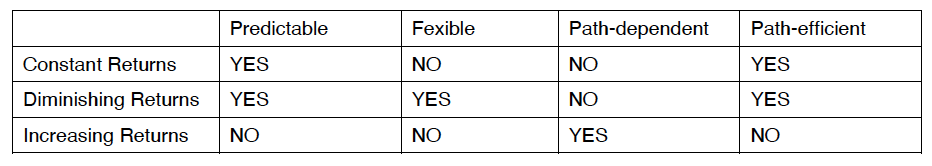

Arthur assumes that there are three regimes based on (i) constant returns, (ii) decreasing returns, and (iii) increasing returns, and those regimes result in different outcomes:

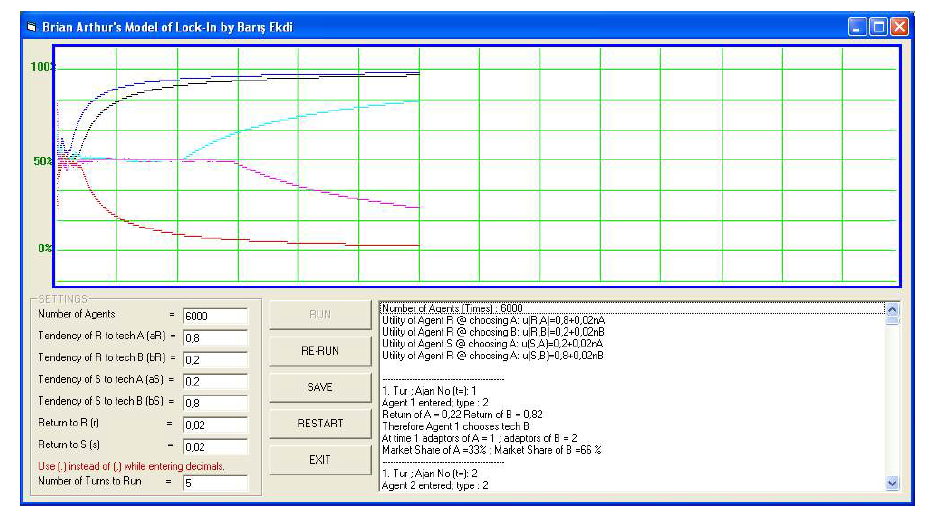

Therefore, the market shares of competing technologies are analyzed through a simulation in this work.

To read the documentation about the program, click on the following link:

To read the documentation about the program, click on the following link: